Exposing the Barclays LIBOR Rigging Scandal (Infographic)

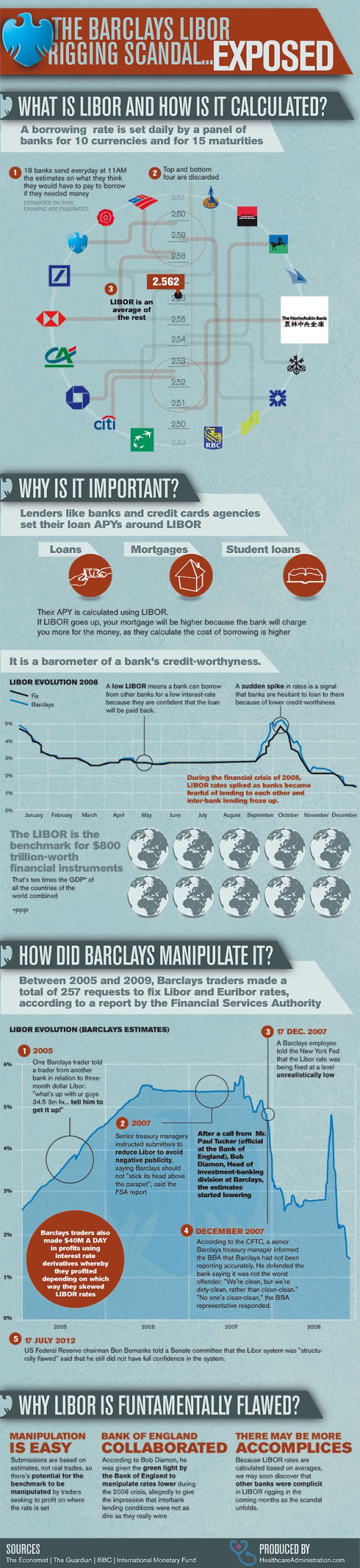

Since (at least) 2005, Barclay’s has been manipulating LI(E)BOR, and their traders have been allegedly pocketing $40MM A DAY betting on interest rate derivatives. If the LIBOR, one of the most fundamental metrics of our banking system can be rigged, can you imagine what other elements of our financial system are a fraud?

Embed this image on your site (570px wide)

Skinny version (450px wide)

DISCLAIMER: THE VIEWS EXPRESSED IN THIS INFOGRAPHIC AND THE USER GENERATED COMMENTS BELOW DO NOT REFLECT THE VIEWS OF HEALTHCAREADMINISTRATION.COM

Credits: Economist, IMF, Rolling Stone, HMC, The Guardian, BBC, BBA, Bloomberg